It’s a fascinating time to be in finance, especially for those of us who enjoy a challenge, change, and personal growth. For those who don’t, the way ahead could be tough. Industry 4.0 becomes the prevailing paradigm for manufacturing, finance, new technologies, collaborations and new ways of thinking need to be embraced.

Industry 4.0-driven Realities

To my mind, there are two Industry 4.0-driven realities that separate modern finance workers from our predecessors:

- They are increasingly conversant with technology

- They are capable of creating strategies that both motivate and capitalize on technology expenditures

For some of us, that creates a departure from the old days, when strategizing was rarely more important than managing the growth and preservation of capital. In order to remain competitive in a tech-dominated world, large investments need to be made into nascent technologies, many of which are more difficult to assess for ROI than was typical of expenditures in the days when capex walked hand-in-hand with economies of scale.

Shifting from Economies of Scale to Economies of Technology

Today, as we shift from economies of scale to economies of technology, finance workers are asked to assess, recommend, and help implement major IT projects. And there’s the rub – since it’s not in our nature to spend money on things we don’t understand, we need to redefine the way we approach these tech-budget allocations. The best way I can think of to do that is by expanding the scope of our job descriptions to include a deep understanding of the technologies themselves, as well as their financial ramifications, and opportunities.

The changing scope of financial workers is nowhere more apparent than in the CFO’s office. The modern CFO is champing at the bit to create digital disruption within his or her own organization. To effect change, this new breed of CFO is motivated to forge a strong connection with the CIO. While it has always been important for finance and technology to work together, today it’s a make-or-break alliance. If CFOs and CIOs are not on the same page, IT spending is much less likely to align with strategy, support leadership’s priorities, create tangible value, improve business performance or drive growth.

ERP – the Prerequisite to Industry 4.0 Innovations

- Data presented in a timely, accurate, usable manner

Not wishing to be left behind, I’ve been spending time considering the financial technologies currently at our disposal. Our greatest asset, of course, is our ERP, the prerequisite to Industry 4.0 innovations. Data is the lifeblood of ERP and the holy grail of financial workers. In the past, business decisions were often made with inadequate or incomplete information. Today, we are inundated with data – the problem is not its lack, but the ability of our business systems to gather and present what we need in a timely, accurate and usable manner. In regard to ERP, I would like to pass along two observations that can mean the difference between ERP success and ERP failure.

This might seem obvious, but it’s an oft-forgotten point. Processes can vary enormously between industries, and the finances and operations of a widget maker are not the finances and operations of a food & beverage company. Sadly, thousands of companies have implemented ERPs that were initially designed for companies in other industries. This helps to explain the high rate of ERP implementation failures and dissatisfaction.

- Your ERP should be your company’s Single Source of Truth (SSoT)

At the end of the day (as at the end of the quarter and the end of the year) it is extremely important that your numbers reconcile. This is much more likely with an ERP that promises an SSoT than it is with a Frankenstein’s-ERP that’s been patched and modified with ad hoc solutions especially solutions that require their own databases. To realize the benefits of Industry 4.0, your data must be pure, and if your data doesn’t come from a single source of truth, as they say in the movies, forget about it.

Augmented Analytics – Next Generation Financial Software

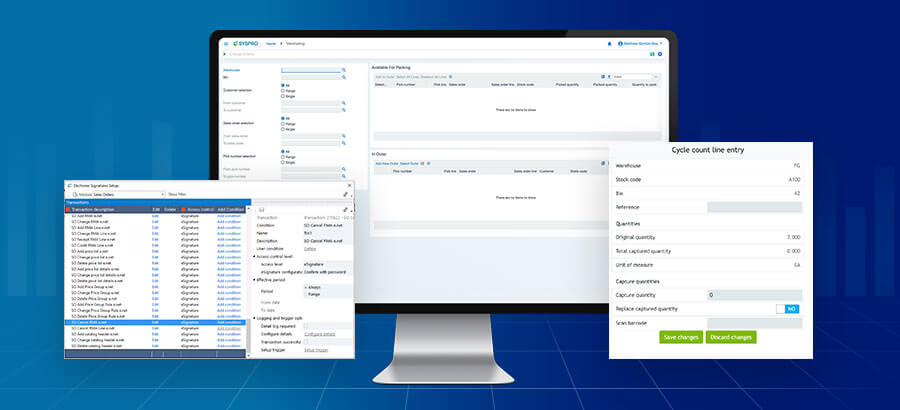

For finance workers in manufacturing, an ERP solution such as SYSPRO provides huge value by providing intelligent Corporate Performance Management (CPM) capabilities that specifically integrate tools from Industry 4.0, including Augmented Analytics, which Gartner claims will be a significant driver of new purchases by 2020. According to Gartner:

“Augmented analytics is a next-generation data and analytics paradigm that uses machine learning to automate data preparation, insight discovery and insight sharing….”

To provide Industry 4.0 benefits to finance workers in manufacturing, and to finally bring an end to the use of spreadsheets (which are disconnected, time-consuming and non-collaborative), SYSPRO has partnered with Prophix, a leading developer of next-generation financial planning and analysis software.

While retaining many of the familiar features and workflows of a spreadsheet, Prophix liberates finance workers from repetitive processes such as data imports, report generation, and allocations, while adding features that enhance collaboration and productivity for the entire department. Together, SYSPRO and Prophix allow manufacturing companies to fully integrate operational and financial planning, and to easily streamline management and budgeting processes.

To my mind, systems like Prophix are a significant step towards the future of finance in the world of manufacturing. In my next blog, I’ll discuss the specific ways that Prophix and SYSPRO combine to rationalize your business processes and improve your company’s profitability.