Even before the pandemic, global supply chain were fragile thanks to factors such as the US-China trade war, less efficient shipping routes and a huge drive to cut costs by consolidating loads. Just as manufacturers and distributors were starting to climb out of the ‘COVID hole’, they’ve been knocked back in. Now, the greatest risk they face has shifted to the regional instabilities due to military conflict and the geopolitical and economic uncertainties it has created. This latest development will exacerbate the situation for companies in many industries, particularly those which are heavily reliant on energy resources.

The war and imposed sanctions will create a knock-on effect across the supply chain, and businesses will be impacted by material shortages, material cost increases, demand volatility, logistics and capacity constraints as well as cybersecurity breaches. Even companies without a direct supplier connection in Russia or Ukraine will experience debilitating disruption across industries from energy to agriculture.

Unpacking expected disruptions across the supply chain for manufacturers and distributors

European countries which import Russian oil and natural gas are going to be hard hit. On top of that, uncertainty over the conflict will lead to higher oil and natural gas prices worldwide, even if additional supply outside of Russia comes online. This will benefit oil-exporting countries and be detrimental to oil importers.

Rising oil prices will also have a cascading impact on supply chains in areas such as higher line-haul trucking rates and other transportation costs. Already, oil prices have reached their highest levels since 2014 and are expected to continue to rise. Russia is the world’s third-largest oil producer and the second-largest foreign oil supplier to the US.

The transportation industry will also bear the brunt, as it has the highest energy intensity of all major industries. Shipping costs skyrocketed over 300% in 2021 as borders and ports were closed around the world in response to the pandemic, and these will continue to be elevated.

Transportation and logistics are key to a wide range of industries from processed food to advanced industrial manufacturing and particularly affect those that rely on inputs from many different parts of the world. Where energy extraction is upstream, and freight and transportation midstream, the impact of the military conflict will also be felt in industries where oil and gas are refined and used to make rubber, preservatives, plastics, containers and many other products that play an important role in the agricultural and medical fields.

Severe shortages of hydrocarbon, critical minerals, metals and energy are expected. Prices for those items will probably spike thanks to shortages as well as irrational buying and protectionism. This will in turn impact manufacturing operations up- and downstream as much as raw material mining.

Supply chain survival strategies that manufacturers and distributors can leverage

The situation sounds serious, and it is, yet there are steps manufacturers and distributors can take to survive – and even prosper – in the face of these exceptional challenges. In the long-term, supply chain leaders must increase resilience by balancing investments in dedicated teams, processes and technologies that will enable their organizations to implement end-to-end risk management.

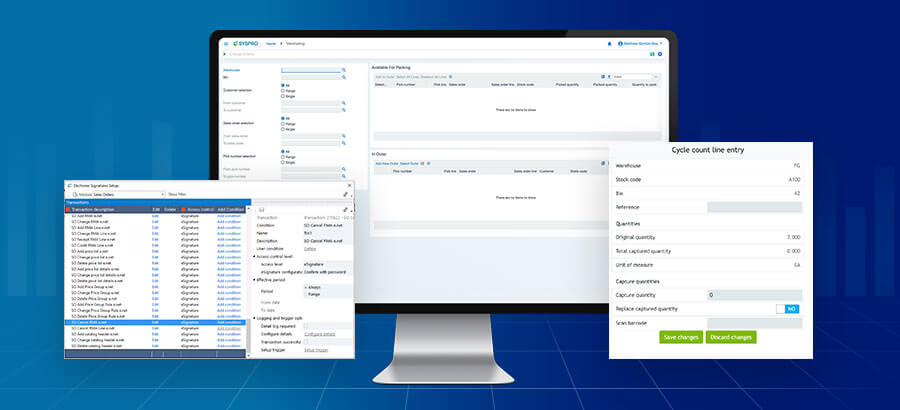

In the crucial short term, however, companies can navigate the risks by improving their visibility beyond their immediate suppliers and stocking up on key materials. The need for full visibility along the supply chain is critical as it enables manufacturers and distributors to adapt and adjust as effectively as possible, providing desperately needed certainty to their production planning processes. Optimum visibility levels can be achieved through technologies such as Enterprise Resource Planning (ERP), which integrates solutions such as Material Requirements Planning solutions, supply chain portals and data analytics.

Here are a few more strategies to help with managing the supply chain and improving risk management techniques:

- Reduce the impact of risks by diversifying your supply chain and create a dual or multiple supply chains for critical components. Revisit your sourcing arrangements with suppliers, especially with a view to geographic location. Onshoring and Near shoring comes into play here but be aware that it is a long-term strategy which requires a complete business model shift. Sometimes local capability needs to be developed, or the quality and cost don’t meet requirements.

- Where possible, lock in transportation and shipping costs by partnering with third-party logistics companies to defray labor, warehousing and transportation costs.

- Consider holding safety stocks where applicable to prevent breaks in production.

- Develop business continuity plans with your suppliers.

- Cyber warfare may increase in multinational companies in retaliation against sanctions imposed on Russia. Put your logistics, supply chain and procurement teams on high alert for computer viruses and increased phishing attempts.

The organization needs to give themselves enough time to analyze and develop the second or third supply chains as these processes take a lot of time and effort, as well as carefully invest in the extra inventory. It needs to be a carefully considered strategy with, in most cases, a time phased plan to implement.

Out of hardship come opportunities: leverage the possibilities with ERP

ERP, underpinned by a robust MRP, with supply chain portals and data analytics solutions – are key to identifying and making the most of the opportunities which will inevitably come out of the current hardships brought about by the military conflict.

There’s no doubt that the disruption will offer companies opportunities to improve their supply chain systems so that they can better predict future issues. Again, the biggest factors here are supply chain visibility, resiliency and flexibility. Those which are flexible enough to pivot their offerings on short notice will always fare better, as we saw during the pandemic lockdowns when some manufacturers and distributors even grew their businesses by adapting successfully.

We all know that things are going to change. Having the technical skills and capability to manufacture items that address the shortfalls will be a huge plus. And when the conflict ends, those developments will still be there to create even further competitive advantage.

Consider that substitute products are often developed in times of hardship, and that in many cases the world doesn’t revert to the products that were used in the past. For example, aluminum was in short supply during World War II. The British adapted by building the de Havilland Mosquito, a combat aircraft constructed mostly of wood. Similarly, Land Rover’s serendipitous use of aluminum in response to a shortage of steel after the war has stuck: five of their seven series of vehicles are aluminum bodied even today.

Toyota also responded to vast shortages in Japan after World War II by developing an entirely new production system (the Toyota Production System or “Lean manufacturing”) that aimed to use the least amount of material and reduce wastage. That system has influenced production systems across the globe.

The control you need, with the experience you want

While exact predictions are impossible at this point, ultimately the military conflict between Russia and Ukraine will lead to further changes once it’s over.

As happened during the pandemic, the impacts of the conflict will compel manufacturers and distributors to refine and improve their business models, positioning customers at the center and redesigning their supply chains from the customer back to the raw materials. This will call for closer inspection of the supply chain as well as tighter collaboration with suppliers.

Technology will be used strategically to ensure full visibility, enabling accurate decision-making and planning.